MicroStrategy Isn't Dead

A deep dive into MSTR's Bitcoin strategy, debt structure, and why the bearish sentiment might be creating a generational opportunity.

Why MicroStrategy Isn't Dead

Alright, here's the rundown because I've been going insane reading Twitter doomers and old-stock-market-book NPCs who clearly don't understand what MSTR actually is.

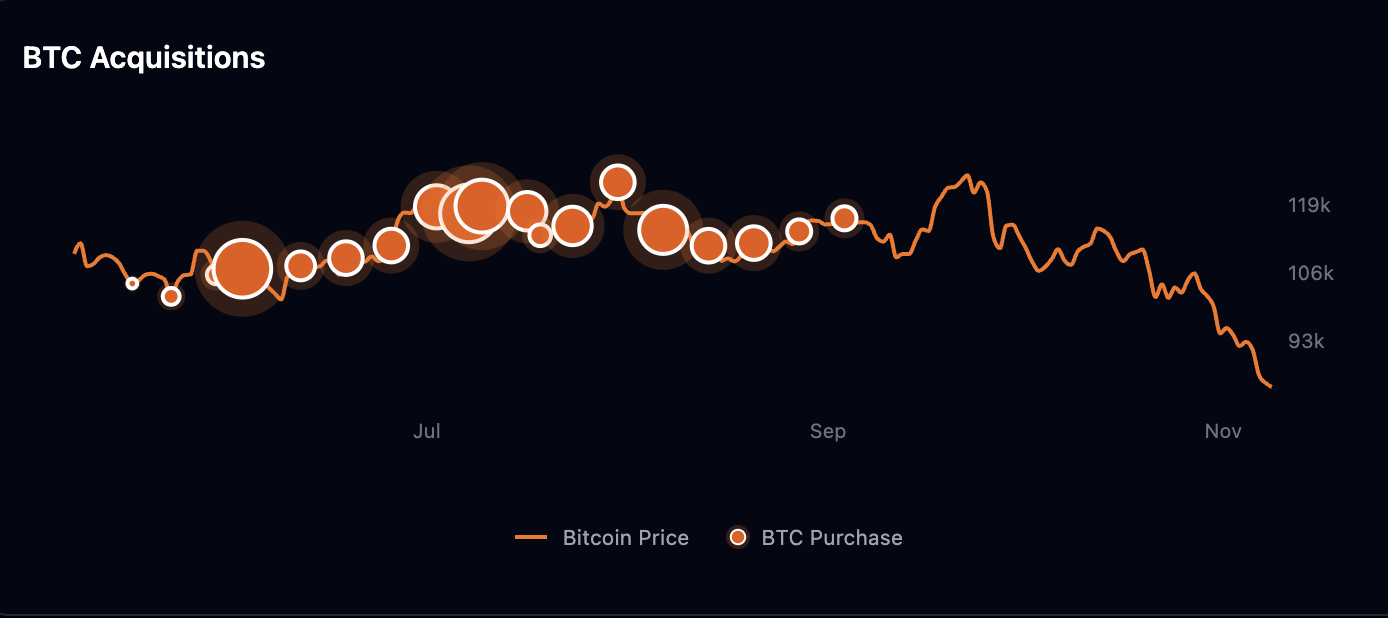

The Chart Looks Like Death, But It Doesn’t Matter

Yeah, the chart is horrific. Straight down. Looks like someone tied it to a sinking ship.

But the chart is reflecting:

- dead sentiment

- premium compression

- quant hedging

- MSCI flows

- retail panic

- nothing structural

This isn’t insiders dumping. This isn’t a business collapsing. It’s just the reflexive part of a BTC proxy bleeding in a liquidity vacuum.

When BTC wakes up, this thing doesn’t move a few percent. It can explode 50–200 percent in a single leg.

The Real Risks (There’s Basically Two)

Everything else is noise.

1. Dilution becomes unattractive in a downturn

When MSTR trades below NAV, issuing shares is inefficient. So they slow BTC buying. Not a crisis, just less stacking.

2. Bitcoin doesn’t pump before 2028

This is the only real structural risk. If BTC stays dead for 3–4 years while maturities approach, refinancing gets annoying. Not impossible, just less smooth.

Everything else (MSCI, charts, short interest, FUD, ponzi memes) is background noise.

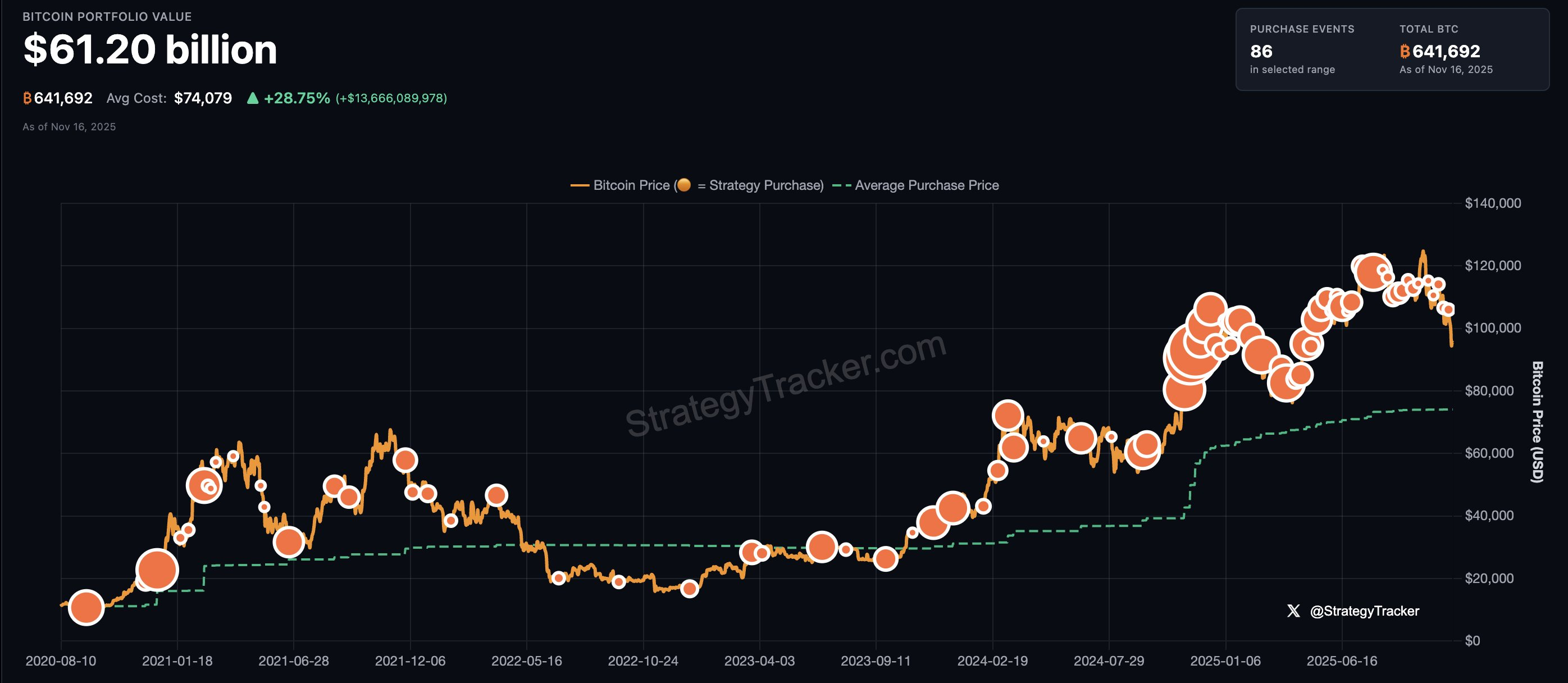

The Debt Stack Is a Joke (In a Good Way)

Once I actually looked at the numbers I realized how overblown all the fear is.

Total convertible debt: ~$8.2B

Average interest rate: 0.4%

Earliest maturity: 2028

Zero collateral.

Zero margin calls.

Zero forced selling.

The debt disappears in bull markets because it converts to equity at prices like $150, $180, $230, $430, $670.

If Bitcoin has a pulse, the debt melts away.

Not All Bitcoin Treasuries Are Built the Same

People lump all these Bitcoin treasury companies together like they’re running the same play as MicroStrategy. They’re not.

Take H100 for example. They haven’t added a single BTC in months and their mNAV is around 0.67, which tells you the market isn’t giving them any trust or premium to work with.

It’s not that they don’t want to buy more. They just can’t. When you’re a small cap with low liquidity, you can’t raise capital in a cold market. No one is handing you unsecured convertibles, and issuing equity below NAV torches shareholders. So they wait.

MicroStrategy is the opposite. They can raise billions because they have scale, liquidity, and real institutional attention. They can tap markets even when sentiment sucks. That’s why they can keep executing the strategy nonstop while small caps stall the moment conditions tighten.

Same idea on paper. Completely different reality.

MSTR can operate in all conditions. Smaller treasuries only function when the market is easy.

The Attention Economy Advantage

We're also living in an attention economy, and this is another spot where Saylor has a straight-up monopoly. Every time Bitcoin enters the conversation, he's the guy everyone quotes. Media calls him, institutions listen to him, and retail treats him like the mascot of corporate Bitcoin. That attention becomes leverage. It's easier for him to raise money, easier to issue converts, easier to float equity, and easier to keep the whole machine running. Smaller treasuries don't get any of that. No one is refreshing H100's investor page or clipping their interviews. Attention translates directly into capital, and Saylor owns that field.

Below NAV Isn't Bearish

People freaking out about mNAV below 1 are missing the point.

Below NAV means:

- low premium

- max fear

- discount zone

This is also where the attention economy becomes a real edge. Smaller treasuries bleed out when they sit below NAV because they can't raise a cent. No liquidity, no interest, no premium, no way out. Meanwhile Saylor can literally pick up the phone, call one of his contacts, raise capital on the spot, and slurp BTC at the bottom while everyone else is stuck watching. Historically this is where MSTR bottoms before ripping once BTC wakes up.

They also already hold 649,870 BTC. They can afford to do nothing for longer periods than other treasuries.

Catching Falling Knives

Normally you don’t touch charts that look like this. Livermore’s whole thing was that weakness usually means something is actually breaking, and you wait for confirmation instead of trying to be clever. But his rules were built for companies with real business deterioration, failing demand, bad balance sheets, or collapsing sectors.

MicroStrategy isn’t in that category. The chart looks like a disaster, but the underlying structure hasn’t changed at all. The debt is long-dated and unsecured, the BTC stack is massive, and the only thing that’s fallen apart is sentiment. So in this one specific case, catching the falling knife isn’t about fighting fundamentals. Companies like this did not exist back in the day, the rules of the game has changed.

If BTC has another cycle before 2028, this setup has the potential to flip violently. This is one of those rare moments where the knife looks dangerous, but is actually worth catching.